When it comes to navigating the world of auto insurance, finding the most affordable full coverage policy is key. This guide delves into the intricacies of the insurance industry, offering insights and tips to help you secure the best deal possible.

Exploring the factors that impact insurance costs and the importance of thorough research will empower you to make informed decisions about your coverage.

Understanding Auto Insurance Coverage

Auto insurance coverage is essential for protecting yourself and your vehicle in the event of an accident or other unforeseen circumstances. Full coverage auto insurance is a comprehensive policy that includes various components to provide extensive protection.

Components of Full Coverage Auto Insurance

- Liability Coverage: This component covers damages and injuries you cause to others in an accident.

- Collision Coverage: Helps pay for repairs to your vehicle after a collision with another vehicle or object.

- Comprehensive Coverage: Protects your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Covers you if you're in an accident with a driver who has insufficient or no insurance.

Comparison with Other Types of Auto Insurance Policies

Full coverage auto insurance offers more extensive protection compared to other types of policies like liability-only or collision-only insurance. While full coverage may cost more, it provides broader coverage and peace of mind in various situations. It is important to assess your needs and budget to determine the most suitable type of auto insurance for you.

Factors Affecting Auto Insurance Costs

When it comes to determining auto insurance premiums, several factors come into play that can significantly impact the cost of coverage. Understanding these key factors can help individuals make informed decisions when shopping for auto insurance.

Driving Record

A major factor that influences auto insurance costs is the driver's record. A clean driving record with no accidents or traffic violations typically results in lower insurance premiums. On the other hand, drivers with a history of accidents, speeding tickets, or DUIs are considered high-risk and may face higher insurance rates.

Location

Another important factor affecting auto insurance costs is the driver's location. Insurance companies take into account the area where the insured vehicle is primarily driven. Urban areas with higher rates of accidents, theft, and vandalism tend to have higher insurance premiums compared to rural areas with lower crime rates.

Deductibles

Deductibles play a significant role in determining insurance costs. A deductible is the amount the policyholder must pay out of pocket before the insurance coverage kicks in. Choosing a higher deductible typically results in lower monthly premiums, but it also means higher out-of-pocket expenses in the event of a claim.

On the other hand, a lower deductible leads to higher monthly premiums but lower out-of-pocket costs when filing a claim.

Researching Auto Insurance Providers

When looking for the cheapest auto insurance with full coverage, it is essential to research different insurance providers to find the best rates and coverage options for your needs.

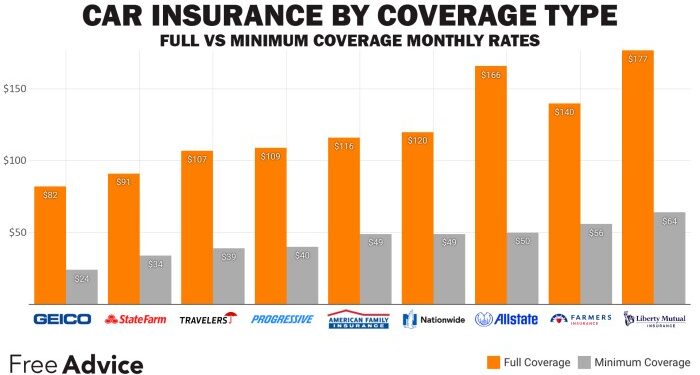

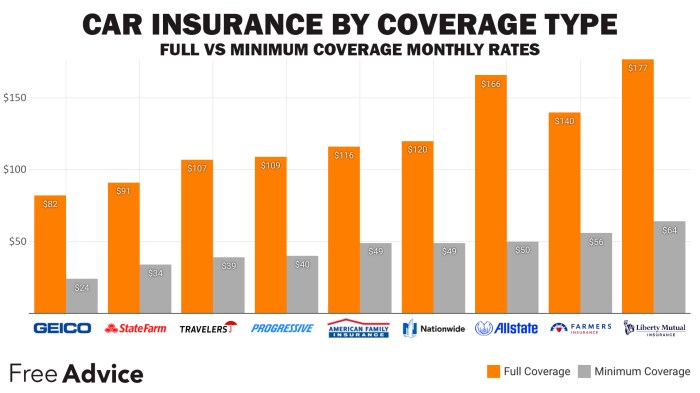

Popular Auto Insurance Companies Offering Competitive Rates

- GEICO: Known for competitive rates and various discounts.

- Progressive: Offers a Name Your Price tool for customized coverage options.

- State Farm: Provides personalized service and competitive rates for customers.

Comparing Customer Reviews and Ratings

- Check websites like J.D. Power and Consumer Reports for customer satisfaction ratings.

- Read customer reviews on platforms like Yelp or Google to get an idea of the overall experience with each provider.

- Consider factors like claims processing, customer service, and overall satisfaction when comparing reviews.

Importance of Researching Multiple Providers

Researching multiple auto insurance providers allows you to:

- Compare coverage options and rates to find the best value for your money.

- Ensure you are getting the coverage you need at a price you can afford.

- Identify any potential discounts or savings opportunities offered by different providers.

Tips for Finding Affordable Full Coverage Auto Insurance

When looking for full coverage auto insurance that fits within your budget, there are several strategies you can use to lower your insurance costs without compromising on coverage

Another important factor to consider is the impact of your credit score on the cost of your insurance premium. Additionally, bundling policies can also help you secure affordable full coverage auto insurance.

Utilize Discounts Offered by Insurance Providers

Insurance providers often offer various discounts that can help reduce the cost of your full coverage auto insurance. Some common discounts include safe driver discounts, multi-vehicle discounts, and discounts for taking a defensive driving course. By exploring the discounts available to you, you can lower your insurance costs significantly.

Consider Bundling Policies for Potential Discounts

Combining different insurance policies, such as auto and home insurance, with the same provider can result in substantial discounts on your premiums. This practice, known as bundling, is a great way to save money while still maintaining full coverage on your auto insurance policy.

Be sure to inquire with your insurance provider about potential bundling discounts.

Maintain a Good Credit Score

Your credit score can have a significant impact on the cost of your auto insurance premium. Insurance companies often use credit scores as a factor in determining rates, with higher scores typically resulting in lower premiums. By maintaining a good credit score, you can secure more affordable full coverage auto insurance.

Utilizing Online Comparison Tools

When it comes to finding the cheapest auto insurance with full coverage, online comparison tools can be incredibly helpful. These tools allow you to compare quotes from multiple insurance providers quickly and easily, helping you find the best deal for your specific needs and budget.

Using Comparison Websites Effectively

Comparison websites are user-friendly platforms that allow you to input your information once and receive quotes from various insurance companies. Here's a step-by-step guide on using these websites effectively:

- Visit a reputable comparison website that is known for providing accurate quotes.

- Enter your personal details, vehicle information, and coverage requirements.

- Review the quotes from different insurers and compare the coverage options and prices.

- Select the policy that best fits your needs and budget.

Reviewing Quotes for Cost Savings

It is essential to review quotes from different insurers to maximize cost savings. Each insurance company has its own way of assessing risk and calculating premiums, so prices can vary significantly between providers. By comparing quotes, you can ensure you are getting the most affordable full coverage auto insurance policy.

Understanding Discounts and Savings Opportunities

When it comes to finding affordable full coverage auto insurance, taking advantage of discounts and savings opportunities can significantly reduce your premiums. Insurance companies offer various discounts to policyholders based on different factors. Understanding these discounts can help you save money on your auto insurance.

Common Discounts Offered by Insurance Companies

- Multi-Policy Discount: Insurance companies often provide discounts to policyholders who bundle their auto insurance with other types of insurance, such as home or renters insurance.

- Good Driver Discount: If you have a clean driving record with no accidents or traffic violations, you may qualify for a good driver discount.

- Good Student Discount: Students with good grades can often receive discounts on their auto insurance premiums.

Factors like Vehicle Safety Features Leading to Reduced Premiums

- Installing safety features in your vehicle, such as anti-theft devices, airbags, and anti-lock brakes, can help reduce the risk of accidents and theft. Insurance companies may offer discounts for vehicles equipped with these safety features.

- Driving a car with a high safety rating can also lead to lower insurance premiums, as safer vehicles are less likely to be involved in accidents.

Potential Savings from Loyalty Programs or Safe Driving Incentives

- Some insurance companies reward loyal customers with discounts for renewing their policies or staying with the same insurer for a certain period.

- Participating in safe driving programs, such as usage-based insurance or telematics, can also result in savings based on your driving behavior and habits.

Closing Notes

In conclusion, understanding the nuances of auto insurance and actively seeking out savings opportunities can make a significant difference in the cost of your policy. By utilizing the information provided in this guide, you are better equipped to find the cheapest auto insurance with full coverage that meets your needs.

Quick FAQs

How can I lower my auto insurance costs without sacrificing coverage?

You can consider increasing your deductibles, bundling policies, and maintaining a good credit score to secure affordable full coverage auto insurance.

What role do online comparison tools play in finding cheap auto insurance?

Online comparison tools allow you to easily compare quotes from different insurance providers, helping you identify the most cost-effective option for full coverage.

Are loyalty programs and safe driving incentives significant in saving on insurance costs?

Yes, loyalty programs and safe driving incentives can lead to potential savings on your auto insurance premiums, making them valuable options to explore.